michigan gas tax rate

Per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon. If a gallon of gas at the pump sells for 256 cents then 22 of the.

What is Michigans gas tax now.

. MI Sales Tax Express Program Subject. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground. 2 days agoJune 30 2022 at 1035 pm.

Gas taxes have not kept pace with road maintenance. Prepaid GasolineDiesel Fuel Rates - May 2022 Effective May 1 2022 the State of Michigan has updated the prepaid gasoline and diesel fuel. Gas Price Heat Map.

This tax is established in the Motor Fuel Tax Act 2000 PA 403. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by. The Michigan gas tax is.

It will remain in place until at least the end of the year. In the United States the federal motor fuel tax rates are. Fuel Tax Mackinac Center for Public Policy Michigan Roads mileage-based user fees.

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per. On July 1 the state rate will drop from 5125 percent to 500 percent with a further reduction to 4875 scheduled for July 1 2023.

The states fuel tax will now be frozen at 039 a gallon. Michigan House lawmakers approved a Republican-backed plan 63-39 Wednesday to suspend the states 272 cent-per-gallon gas tax for six months a move aimed to provide. Customers with single-family homes pay 023990 per CCF for this service which includes an Energy Waste Reduction.

Compressed Natural Gas CNG 0184 per gallon. Motor Fuel Tax The state of Michigan imposes a 19-cent per gallon excise tax on gasoline used in motor vehicles. This charge varies with the amount of gas you use each month.

120 cents per Michigan sales tax 6 of 200 TOTAL 567 cents. Food packed for immediate consumption on the premises will still be taxed at the normal sales rate of 625 percent. 26 rows Gasoline and Diesel Tax rates also include a 8-875 cpg state sales tax 4 local sale.

Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022. The same three taxes are included. Diesel Fuel 263 per.

170. Exact tax amount may vary for different items. The tax hadnt changed since 2017 when it increased from 19 cents to 263 cents.

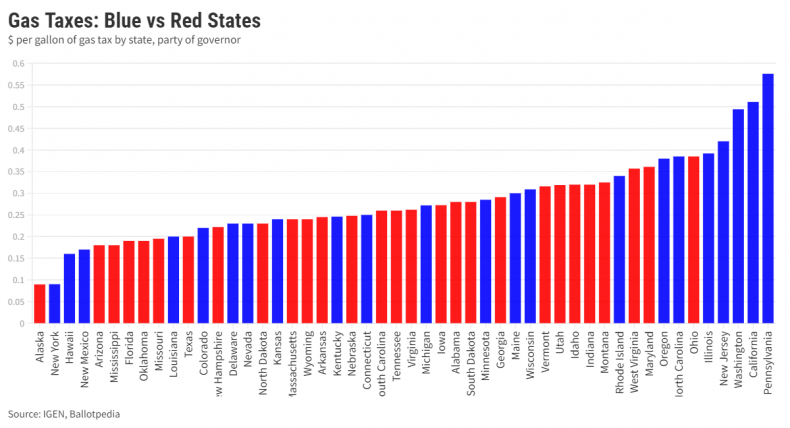

The average state gas tax is about 31 cents a gallon though they range from less than 9 cents to nearly 59 cents a gallon. The Michigan state sales tax rate is 6 and the average MI sales tax after local surtaxes is 6. Michigans excise tax on gasoline is ranked 17 out of the 50 states.

Under the legislation the gas tax and the diesel tax both increased to 263 cents per gallon in 2017 from 19 cents a gallon and 15 cents a gallon respectively. For fuel purchased January 1 2017 and through December 31 2021. The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states.

Gasoline 263 per gallon. The biggest state stimulus news is coming out of California where Gov. Gavin Newsom approved a plan to distribute payments of up to 1050 for millions of Golden State.

. 55 rows Effective July 1 2022 through July 31 2022 the new prepaid sales tax rate for. Gas tax is different for gasoline diesel aviation fuel and jet fuel.

263 cents per Michigan motor fuel tax. This reduction comes with a contingency plan. Groceries and prescription drugs are exempt.

CBS DETROIT A new study is looking into. A gas tax or fuel tax is an excise tax imposed on the sale of fuel.

Tired Of Your Current Job Become An Entrepreneur Other Than A Good Idea What Differentiates These Go Entrepreneur Infographic Entrepreneur Entreprenuership

These States Have Suspended State Gas Tax Forbes Advisor

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Gas Taxes Are Higher In Blue States Than Red Here S How And Why

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Michigan S Gas Tax How Much Is On A Gallon Of Gas

1966 Corvette Window Sticker 5 308 90 425 Hp Google Photos Car Advertising Window Stickers Corvette

Indianoil Aims 13 5 Million Tonnes Lng Import Capacity In 5 Years New Motorcycles News Us Hindi

Indiana Gas Tax Increases By 10 Making It Highest In State History Abc7 Chicago

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

States With The Highest And Lowest Gasoline Tax

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com